Unlocking Hidden Opportunities in UK Consumer Finance

.png)

Customer Credit Profile Insights: Unlocking Hidden Opportunities in Consumer Finance

In our recent posts, we've explored the rising challenge of high decline rates in consumer finance, key UK market trends, and why selecting the right lender is crucial for retailers. Today, let's dive deeper: How well are you truly serving your customers with your current finance providers?

At FinMatch, we help merchants optimise their financing options to capture more sales.

Keep reading to explore real insights on credit profiles and potential gains.

UK Credit Profiles Overview

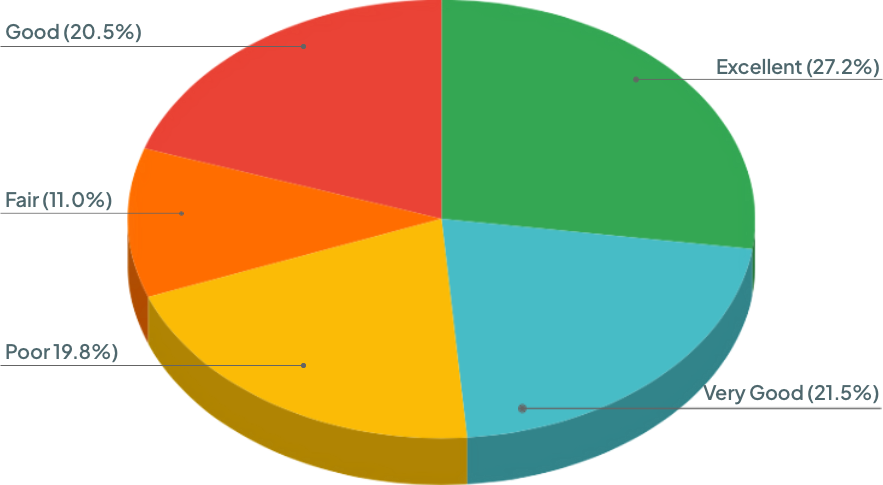

Based on Equifax data, here's the breakdown of UK adults' credit ratings:

This split highlights a key reality: Over half of potential customers may face barriers with mainstream lenders. Are your finance options inclusive enough?

The Affordability Factor

Even consumers with excellent or very good credit ratings aren't guaranteed approval. The Financial Conduct Authority (FCA) mandates that lenders assess affordability before granting loans—meaning income, expenses, and debt levels play a critical role.

Result? High-credit customers can still be declined if affordability doesn't align, leaving retailers with lost sales opportunities.

Specialist lenders, however, often bridge this gap with tailored assessments.

Case Study 1: Jeweller

Average Basket Value: £1,564

Medium/Low Credit Customers: 42%

For high-value, aspirational purchases like engagement rings, many buyers fall into medium/low credit profiles—yet they have the intent and means to buy.

By adding a specialist lender via FinMatch, this retailer saw a 16% uplift in acceptance rates, converting more "almost" sales into revenue.

Case Study 2: Consumer Electronics Retailer

Average Basket Value: £846

Medium/Low Credit Customers: 63%

Electronics shoppers often seek flexible payments for gadgets and appliances, but a majority in medium/low credit tiers get overlooked by standard providers.

Integrating a specialist lender boosted acceptance by 24%, capturing impulse and upgrade purchases from a wider audience.

Case Study 3: Bathroom Retailer

Average Basket Value: £912

Medium/Low Credit Customers: 47%

Home improvement projects like bathroom renovations attract customers across the credit spectrum, but affordability hurdles can stall deals.

With FinMatch's specialist lender addition, acceptance rates improved by 18%, turning browsers into completed sales.

Maximise Your Customer Reach

UK credit profiles are evenly split: ~49% high vs. ~51% medium/low. Affordability checks add another challenge—declining even strong credit applicants.

Retailer case studies show 16-24% acceptance gains by adding specialist lenders.

At FinMatch, we're experts in matching merchants with the right finance partners to serve ALL credit profiles effectively, driving more applications and sales for businesses in jewellery, electronics, home goods, and beyond.

Don't leave revenue on the table—optimise your finance stack today.