A Suite of Financing Solutions for Retail & B2B Merchants.

Unlock new sales & customer loyalty with powerful payment tools.

Unlock new sales & customer loyalty with powerful payment tools.

Increase conversions and enhance customer experience with our powerful finance marketing solution.

Showcase your finance options throughout the customer journey. Whether it's on your product pages, in your online store, or during in-person sales consultations, finance promotions capture customer interest and drive sales. Offer a choice of payment plans to cater to different needs and budgets.

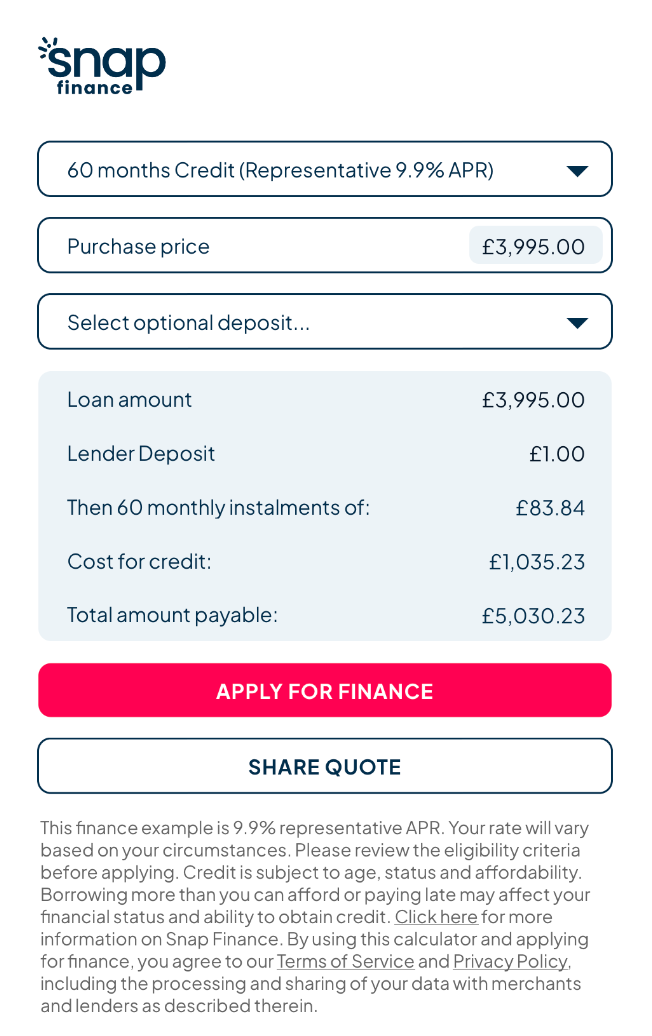

Let customers calculate loans, apply seamlessly, and get an instant decision. Merchants receive real-time email alerts for follow-ups, capturing every opportunity. Effortless setup, full FCA/GDPR compliance. Skyrocket sales and conversions from day one!

Reach every customer with targeted finance promotions. Our app combines navigation elements, modals, and calculators to display the right offers to the right customers. Increase conversion and spend with a single, powerful solution.

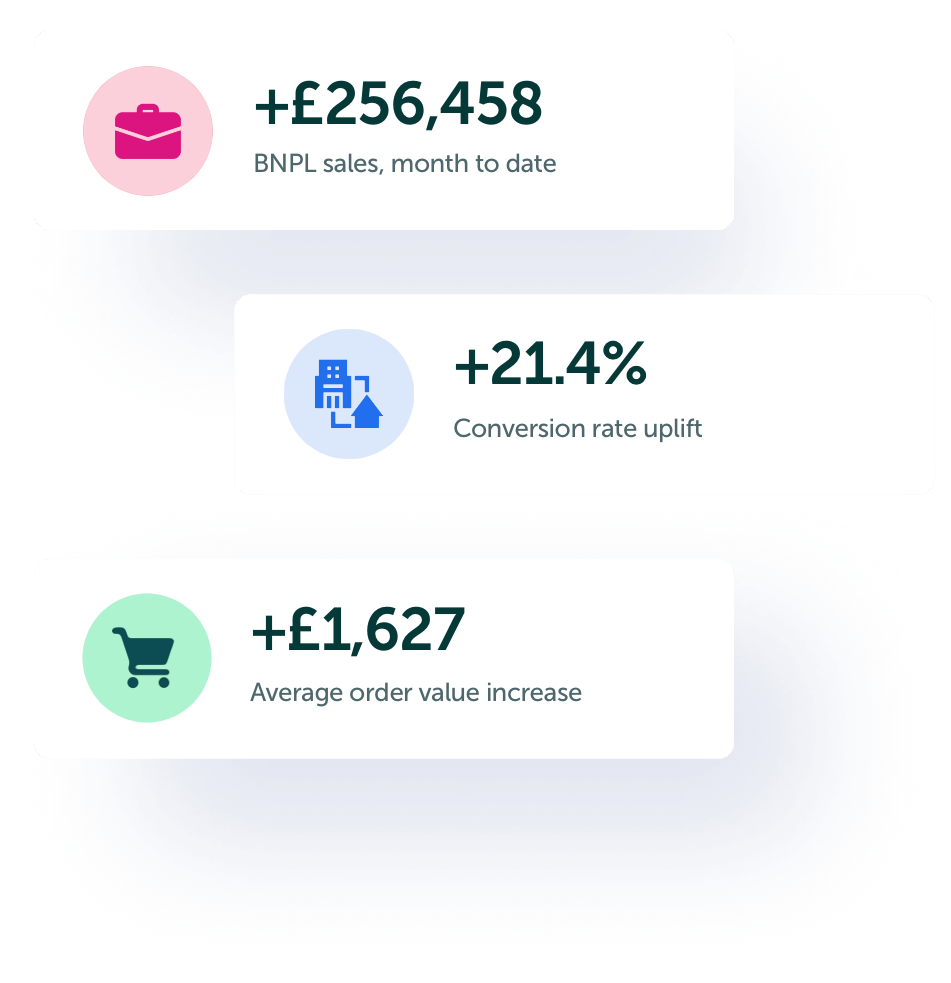

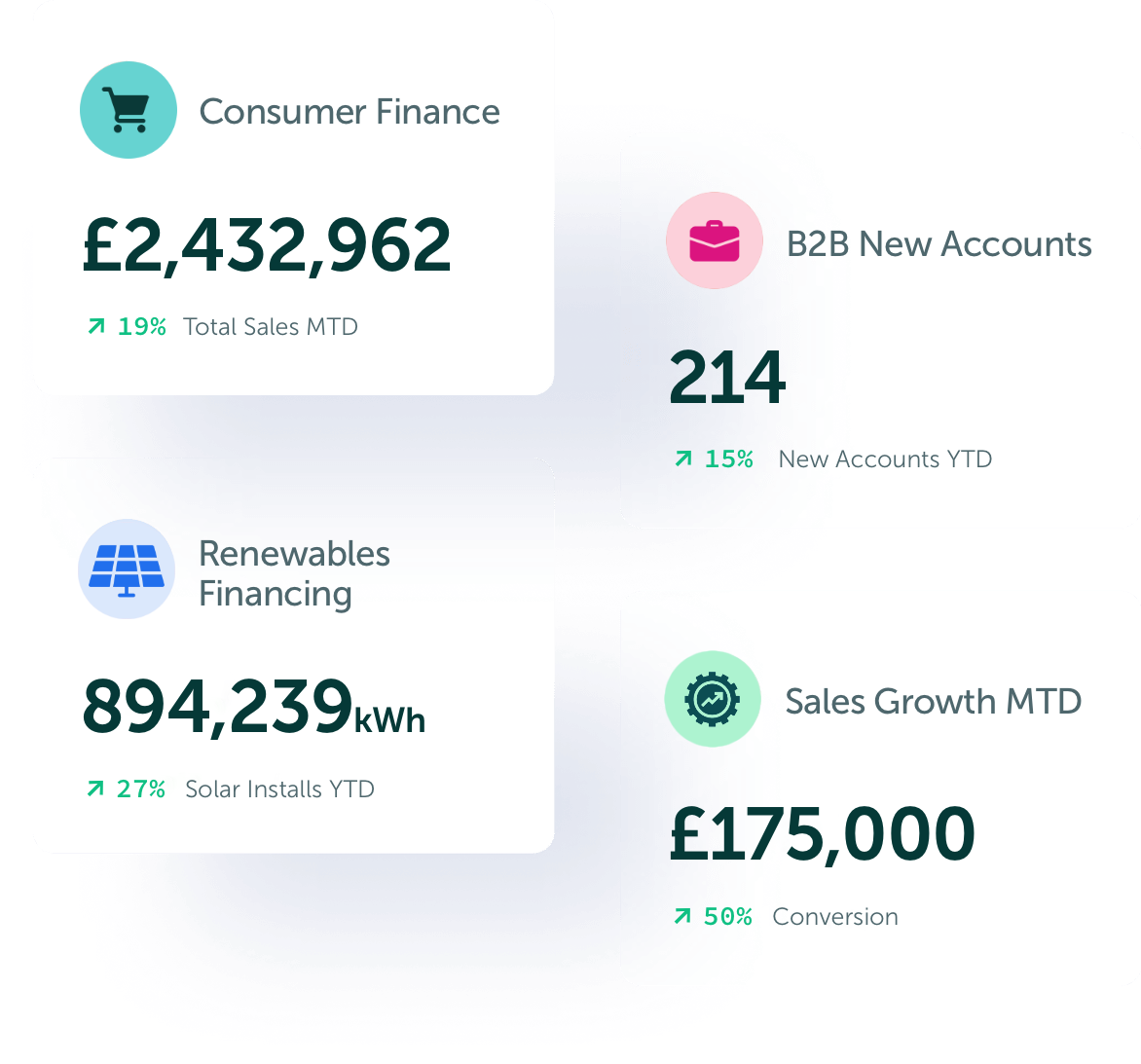

Drive sales and boost your average order value with flexible consumer finance solutions tailored to your business. We partner with the best lenders to offer your customers payment plans from 6 to 180 months on purchases ranging from £250 to £50,000.

Become directly authorised and offer a wider range of finance options to your customers. FinMatch FCA Assist helps UK businesses get authorised quickly and efficiently. For £1,349 we handle the application process, including preparing your regulatory business plan, selecting the relevant permissions, and enabling you to submit your application. Click here to book.

Get paid upfront, while your customers enjoy flexible payment options. Offer your trade customers attractive terms like ‘Pay in 30/60/90 days’ and ‘3/6/12 monthly instalments’. Expand your customer base with our fully automated trade credit solution.

Access £1,000 to £500,000 within days, with no early repayment fees. Use it for bridging cash flow gaps, seizing unexpected opportunities, or managing seasonal fluctuations.With flexible terms, from 1 day to 2 years, you are in control. Click here to apply.